Panie i panowie,

Czas na:

Czas na:

VI Specjalistyczną Konferencję M1

Dla przypomnienia

VSKM1 wideo tu:

Ponownie

zgromadzilismy dużą ilość wysokiej jakości wiedzy i nadszedł moment aby zrobić

kolejny zrzut.

DATA: 22/03/2019 INVEST CUFFS

LOKACJA: 3. piętro ICE CONGRESS CENTRE, Kraków

Agenda:

Mamy konkrety dla

inwestorów w polskie spółki, fanów Ichimoku i dla ludzi szukających czegoś więcej

niż klasyczne typy analiz.

Pokażemy też między innymi jak polować na zmienność.

Pokażemy też między innymi jak polować na zmienność.

Rynki cały czas

ewoluują także jeśli nie bedziemy rozwijać się razem z nimi szansa wyginięcia

wzrasta.

Dlatego tak ważny

jest ciągły rozwój świadomości rynkowej i celem tej konferencji jest zwiększyć

naszą.

Szykuje się

wyjątkowo wartościowe spotkanie, wysoki

poziom merytoryczny i jakość prezentowanych treści gwarantuję osobiście. Przybijam temu wydarzeniu stempel jakości M1.

Szykuje się

wyjątkowo wartościowe spotkanie, wysoki

poziom merytoryczny i jakość prezentowanych treści gwarantuję osobiście. Przybijam temu wydarzeniu stempel jakości M1.

Co się dzieje?

Udało nam się zgromadzić

ekspertów z kilku dziedzin rynków finansowych. Zaprezentują dla nas swoje

podejścia i skupimy sie na bieżących scenariuszach tak aby większość znalazła

coś dla siebie:

I. Dla inwestorów

długoterminowych przekwalifikujemy polskie spółki i nakreślimy obecną sytuację

geopolityczną i makroekonomiczną.

II. W średnim terminie

zaprezentujemy obecne scenariusze na walutach, indeksach i surowcach.

III. Dla

krótkoterminowych traderów pokażemy narzędzia wypracowane w trakcie trwania

projektów M1COOP i Kraków Trader's Laboratory. Bedą to narzędzia analityczne i

egzekucyjne.

Naszymi

ekspertami będą: Krzysztof Abramowicz, Ignac Mostovic, Grzegorz Moskwa,

Jarosław Urbaniak i Trader X

Przekażą

następujące treści:

Założyciel FB

grupy Giełdowi Cynicy

Kanał Twitter

Kanał Twitter

Oficjalnym tytułem jego prezentacji będzie:

Analiza rynku akcji polskich, ze szczególnym uwzględnieniem analizy sektorowej małych spółek.

Zapowiada się ciekawie.

W sekrecie

napiszę, że jako bonus Krzysztof planuje

pokazać wyniki testów zachowania się GPW po zjawiskach typu splity,

wprowadzenie kontraktów terminowych, a nawet zmiany nazw spółek.

Co dalej?

Enigmatyczna

postać na polskiej scenie traderskiej. Jedna

z nielicznych, która w kompetentny sposób potrafi sczytywać dane z rynku opcji.

Do tego tym mniej licznych, które przerobiły metody Antona Kreila. Model makro

Ignaca po części bazuje właśnie na wiedzy zawartej w kursie Antona. To trudny

temat także tym bardziej szacunek za wyciągnięcie z niego wniosków w celu

praktycznych zastosowań. Zapomnijcie o

MT4.

Tytuł prezentacji

Ignaca:

Strukturalne

przewagi rynkowe:

Data mining w

praktyce. Źródła, metody, modele i praktyczne ich wykorzystanie.

Wygląda na to, że

opowie też coś więcej o modelach wykorzystywanych w projekcie COTRT.COM i grze

giełdowej "The Floor".

Jak bedzie?

Zobaczymy..

To nie koniec..

To nie koniec..

Jakby tego było

mało Grzegorz z Jarosławem połączą siły i zrobia nam panel

Geopolityczno-Techniczny.

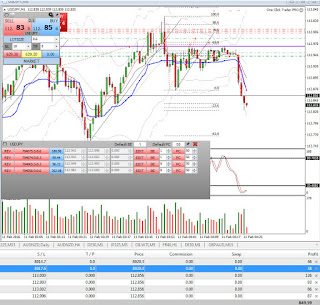

Grzegorza Moskwy

nie trzeba w naszych kręgach nikomu przedstawiać. To legenda polskojęzycznej

sceny traderskiej. Ekspert od świadomego ICHIMOKU potrafiący wykręcać tego typu

wyniki:

Bez komentarza. :)

Jako iż sytuacja

makroekonomiczna zmienia się cześciej niż geopolityczna Jarosław Urbaniak, CEO projektu HTP Trading i uczeń pana Moskwy

nakreśli nam obecną sytuacje geopolityczną aby potwierdzić lub zanegować średniotermiowe

scenariusze rynkowe.

Tytuł ich panelu

brzmi:

Analiza

rynków pod kątem metodologii ichimoku i geopolityki.

Na koniec niespodzianka:

Na koniec niespodzianka:

To podróżnik

zajmujący się wyłącznie handlem na rynkach finansowych o prawie 10 lat.

Przedstawi

nam scenariusze na 2019 rok na podstawie

sytuacji makroekonomicznej, statystyki i sezonowości. Zaprezentuje nam całoroczną

mapę TDOM Concept ( Trading Day of the Month) na bazie pracy Larry'ego Williamsa na

rynku SP500.

Do tego pokaże, na

które dane makroekonomiczne powinnismy zwracać uwagę w trakcie realizowania się

konkretnych średnioterminowych scenariuszy rynkowych.

Pokaże nam jakie instrumenty finansowe najlepiej w tym momencie wyceniają przyszłe wydarzenia i jak na ich podstawie wyszukiwać najbardziej zmiennych walorów w danym okresie.

Wisienką na

torcie bedzie przedstawienia najciekawszych narzędzi i setupów wypracowanych podczas

trwania projektu Kraków Trader's Laboratory.

Jak widzicie szykuje się kolejna solidna konferencja.

Konkret content :).

Jako iż bierzemy udział w komercyjnym wydarzeniu, którym jest kongres inwestycyjny Investcuffs wejście tym razem jest płatne aby przefiltrować niezainteresowanych uczestników, opłacić prelegentów i zrobić coś dobrego..

25-30% gaży po uzyskaniu kosztów konferencji przeznaczymy na konkretny cel charytatywny.

A mianowicie:

Ufundujemy sprzęt komputerowy dla domu dziecka w małym mieście i przy konsultacji prawnej zaczniemy budowę funduszów typu "trust fund" przekwalifikowując polskie spółki w długim terminie dla dzieciaków z małouprzywilejowanych środowisk. Do tego zadbamy o rozwój ich świadomosci rynkowej pokazując im jak wygląda kapitalistyczny system. Wobec filozofii "albo jesteś właścicielem systemu albo stajesz się jego własnością" postaramy sie dać dzieciakom lepszy start w życie rok w rok spotykając się z nimi i zwiększając ich świadomość. Kolejne konferencje będą szły podobnym nurtem.

Więcej informacji wkrótce.

Na ten moment M1 I'm done.

Widzimy się na Cuffsach.

Zapnijcie pasy..

Jak widzicie szykuje się kolejna solidna konferencja.

Konkret content :).

Jako iż bierzemy udział w komercyjnym wydarzeniu, którym jest kongres inwestycyjny Investcuffs wejście tym razem jest płatne aby przefiltrować niezainteresowanych uczestników, opłacić prelegentów i zrobić coś dobrego..

25-30% gaży po uzyskaniu kosztów konferencji przeznaczymy na konkretny cel charytatywny.

A mianowicie:

Ufundujemy sprzęt komputerowy dla domu dziecka w małym mieście i przy konsultacji prawnej zaczniemy budowę funduszów typu "trust fund" przekwalifikowując polskie spółki w długim terminie dla dzieciaków z małouprzywilejowanych środowisk. Do tego zadbamy o rozwój ich świadomosci rynkowej pokazując im jak wygląda kapitalistyczny system. Wobec filozofii "albo jesteś właścicielem systemu albo stajesz się jego własnością" postaramy sie dać dzieciakom lepszy start w życie rok w rok spotykając się z nimi i zwiększając ich świadomość. Kolejne konferencje będą szły podobnym nurtem.

Więcej informacji wkrótce.

Na ten moment M1 I'm done.

Widzimy się na Cuffsach.

Zapnijcie pasy..